The Chief Economist’s blog: The search for security eats into the Finn’s savings

If you read and listen to the public discussion in Finland, it seems like Finnish people finally have been inspired to invest into shares and funds. In the beginning of the year there have been new share owners on the Stock Exchange market as many people are thinking about their finances and alternatives for saving.

Alongside traditional and maybe even difficult investment information there are now Social Media Influencers, who are striving to make investing more ordinary and to make it as easy as possible to take the step into investing. All of this is excellent, especially as during the past ten years, Finns have lost huge amounts of money by directing most of their money into deposit accounts. We are not talking about small amounts of money either as even when taking the inflation into account, it is a question of billions of euros.

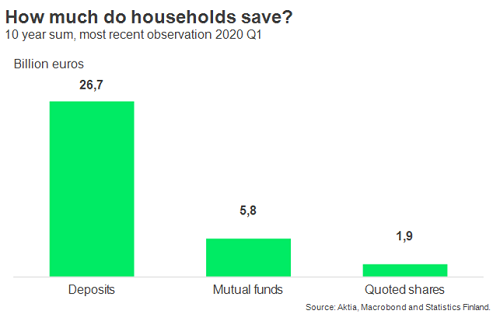

The reality is pictured below. It shows where the Finn's money has poured during the past 10 years. The difference is huge: EUR 27.6 billion into deposit accounts, EUR 1.9 billion into listed shares.

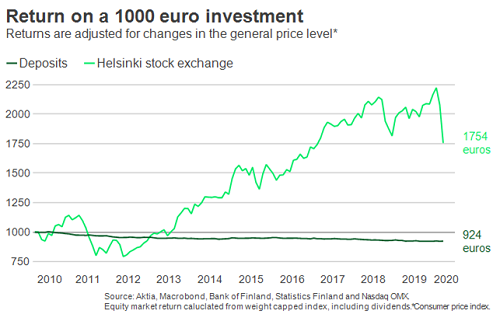

Where would it have been profitable for one to place money, if one would have wanted to keep the savings safe from inflation and increase wealth? In 10 years, the value of the average EUR 1000 deposition has decreased to EUR 924 – meaning that as much as 8 percent has disappeared due to inflation and low interest on deposits. Concurrently, the Helsinki Stock Exchange has returned on average 75 percent per in ten years. A EUR 1000 investment in March 2010 would have grown into about EUR 1 750 profit even though the reference period included one of the steepest stock exchange dips in March 2020 due to the corona crisis.

But why is it still foreign and maybe even scary for most of the Finns to invest in funds and shares? One of the reasons may be that media often depicts investing as either tragic failures or triumphant wins, which is why it often also seems random and risky. That is why many people probably think about the worst thing that could happen when they are considering investing. Especially when you are a new investor, it is good to be aware of the risks and concentrate on long-term share saving instead of pursuing risky quick wins.

But what if the aim was downright boring investing? You could start with very small amounts and see what would happen. Particularly small regular fund investments are a good way to start investing. No great feelings, no great risks – but a great possibility to not lose your money to inflation.

And yes, you can still keep money in deposit accounts – just think about how much and for how long.

Lasse Corin lasse.corin(at)aktia.fi

Twitter: @lassecorin

Aktia is a Finnish asset manager, bank and life insurer that has been creating wealth and wellbeing from one generation to the next for 200 years. We serve our customers in digital channels everywhere and face-to-face in our offices in the Helsinki, Turku, Tampere, Vaasa and Oulu regions. Our award-winning asset management business sells investment funds internationally. We employ approximately 750 people around Finland. Aktia's assets under management (AuM) on 31 December 2019 amounted to EUR 9.9 billion, and the balance sheet total was EUR 9.7 billion. Aktia's shares are listed on Nasdaq Helsinki Ltd (AKTIA). aktia.com.