Read more

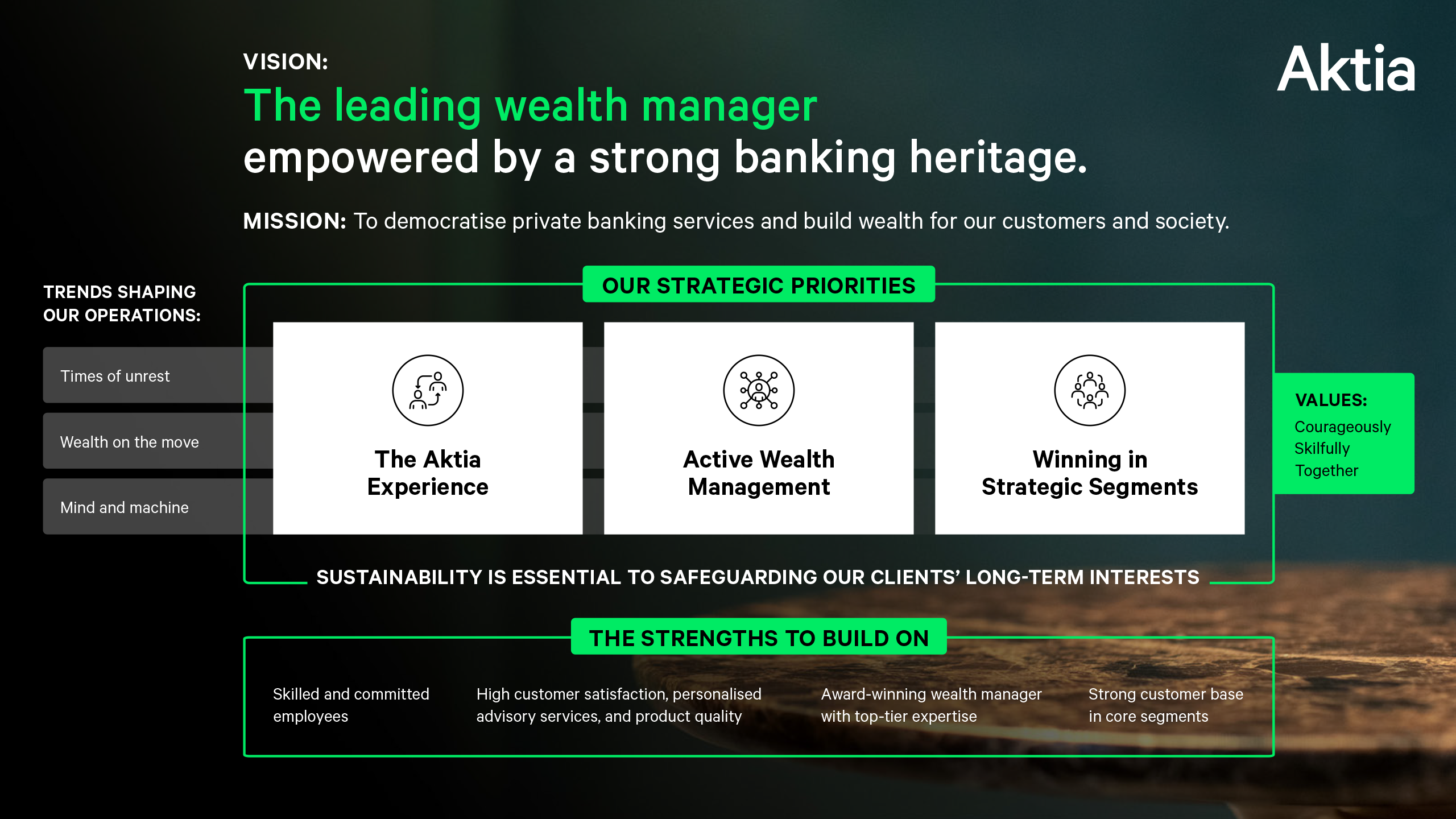

The core of Aktia's growth strategy is to accelerate our journey towards becoming a unique, leading wealth manager empowered by a strong banking heritage.

As wealth transitions across generations, customers need accessible, sustainable financial solutions. Aktia helps customers grow and transfer wealth with clear, long-term plans and a holistic approach.

Finland’s growth relies on bold investments, cross-generational legacies and work, and thriving communities. Aktia takes an active role by driving success in Premium, Private Banking, small and medium-sized enterprises (SMEs), and institutional segments.

We will stand out by specialising in attentive personal service for a growing customer base and by bringing them the Aktia experience. Skilled and committed employees work together to deliver tailored solutions and to respond to the customers’ financial needs and goals.

Read more about the Aktia Experience.

Enhancing our IT setup to enable growth in a scalable and efficient way.

* This figure reflects gross AuM, corresponding to all AuM in the asset management business for which Aktia receives fee commissions. In the future, Aktia will report both gross and net AuM, rather than only net.